All about Stimulus check-update: Expresstech

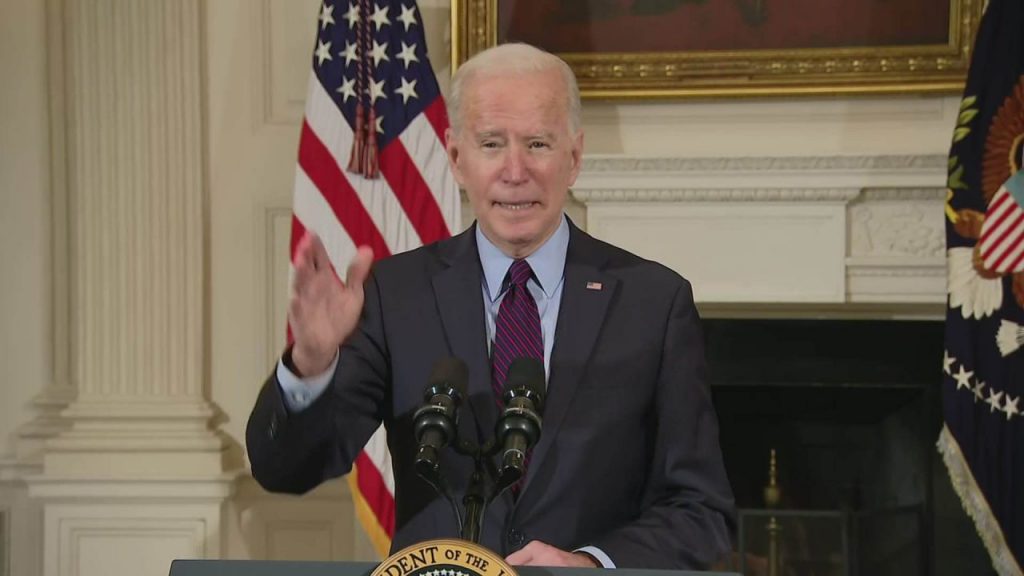

Could the fourth round of stimulus checks become? This question is becoming a topic of heated debate on every platform in America. As 21 democrats in congress have signed a letter asking for recurring payments from president Joe Biden.

2 million people have signed a petition on change.org asking for a recurring $2000 stimulus checks update. But small business owners are against this petition as they are saying that free money makes people not want to work. So the fourth stimulus check update is not yet confirmed. According to some recent research, many people used the first three stimuli to pay their monthly expenses or essentials like food, utilities, rent, mortgage payments, etc.

previous stimulus check update has also increased the amount of tax credit availed by parents on behalf of their children as most parents and legal guardians claimed $3600 for each kid under 6 years old and $3000 for each child from 6-18 years of age.

The American rescue plan act was passed as law in march 2021 and signed by President Joe Biden.

At this time, we can divide the population into 3 categories, firstly those who are paid more than they expected to receive, secondly those who got all the money, and lastly, those whose payments are still unsettled.

However, the IRS is working to help the citizens who are still unpaid. The IRS is distributing full payment to those who have not yet got anything and sending a plus-up amount to those who have some balance payable.

Possible reasons for the delay in stimulus checks?

There are some possible reasons for your stimulus checks update to be delayed or less amount received and some issues you may incur:

- Your check may get stuck in the mail somewhere, so you need to track your mail by contacting the mailing company.

- You have not received the amount on behalf of your dependent like any minor children or older parents.

- There was any calculation error, so you have to request the remaining payment, or you may wait for a plus-up payment.

- Your stimulus check has been deposited to your other bank account that may be closed or not activated.

- You may not file the tax return of last year, so you have to first submit the previous year’s return to claim your stimulus check.

- The IRS doesn’t have your correct mailing address, so you should update your information with the agency.

You may have mistakenly thrown the envelope.

The third stimulus checks to be received:

According to some sources, the stimulus check will go to the eligible taxpayers who have their income up to $75000 per year in the coming week. IRS has also notified in the recent statement that only those citizens will receive these stimulus checks updates which have not received $1400 plus-up payments. It is good news for those who have not received their previous check because the IRS doesn’t have your proper information.

As previously, the payments will be received by the bank deposits. Another option available is that people can receive their financial boosts by mail via postal service.

Fourth stimulus check:

The Fourth stimulus check is yet not decided, but it will be great economic relief for many eligible Americans if it will be coming. As mentioned above, a petition by 2 million people is demanding $2000 million as a fourth stimulus. This petition is gaining much support from many other citizens.

Qualifying criteria for fourth stimulus check:

As for the first three stimuli, this fourth stimulus will also be based on these limits. The first stimulus was for low income and medium-income families, so this one will also be for this community.

But there were some changes in the third stimulus than the second one, as in the third one, the students were also added to this package.

IRS sending out 1 million stimulus payments:

As the agency is relying on the tax return to pay the amount of $1400 and the return of the tax year 2020 was not received totally.

There is good news for those who have not received their checks last time due to different reasons like the agency didn’t have their correct information, or they didn’t file their tax return last year but have done it now. Now the agency is planning to pay 2 million additional stimuli, including:

- 900,000 payment to the people who provide their right information to IRS recently

- 1.1 million as plus up payment to the people who received partial payment before and were still left with some amount due to wrong calculation before they didn’t get paid for their dependents.

The IRS has begun sending payment to those people through bank transfer and via mail.

If you have recently submitted your tax return, it may be possible that you receive your payment last because the agency is slow because of the workload due to the tax return 2020.

What to do if the amount of the third stimulus doesn’t match my calculation?

Sometimes there may be differences in your calculation and IRS calculation.

You can recheck the amount by using the agency’s stimulus check update calculator. You can also check your particular information with the IRS as sometimes they might not have the proper number of your kids or other dependents, etc. If it’s because of this issue, you don’t have to rush for an amended tax form to claim the remaining amount as the agency is working to send plus up payments in the coming weeks ahead.

Some other stimulus reliefs already discussed in 2021:

The government also has some other economy-boosting plans in this pandemic like,

- Child tax credit:

The American government is giving tax credits to your children. You can get a $3600 tax credit for any kid any 6 years and $ 3000 for each child under 18 years. These payments will start this July and end up till the year-end.

- Federal unemployment bonus:

A weekly $300 bonus was granted to unemployed as pandemic unemployment assistance to encourage workers and freelancers.